Online shopping has long established itself as a convenient way to make purchases. Every online retailer tries to provide his customers with the widest selection possible. This includes not only products, but also the different payment methods in the checkout. Studies have shown that a higher number of offered online payment methods increases the shop revenues.

Content

- How many payment methods are there, and which ones are the most popular?

- The most important and popular payment methods

- Choosing the “right” payment method

- Conclusion: compare payment methods

How many payment methods are there, and which ones are the most popular?

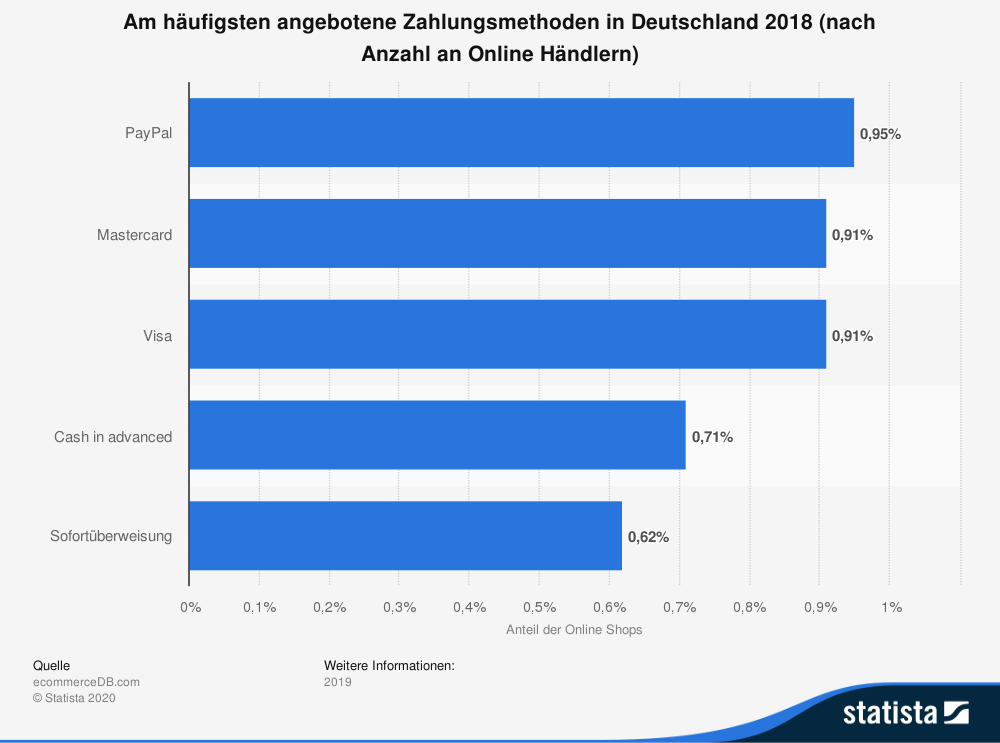

Well, there are many payment methods. By far the most friendly payment method is payment in advance, as the product has already been paid for by the customer before it is even shipped. Many customers, however, rely on PayPal to ensure security when paying, Statista reports in 2019. A less widespread payment method on the internet is buying in installments however, this is expected to increase in the coming years.

The most important and popular payment methods

This article describes the following mobile payment methods on the Internet, their benefits for both retailer and shopper and the associated costs.

- PayPal

- Purchase on account

- SEPA Direct Debit

- Credit card

- Payment in advance

- Instant bank transfer

- Instalment purchase

- Amazon Pay

Payment with PayPal

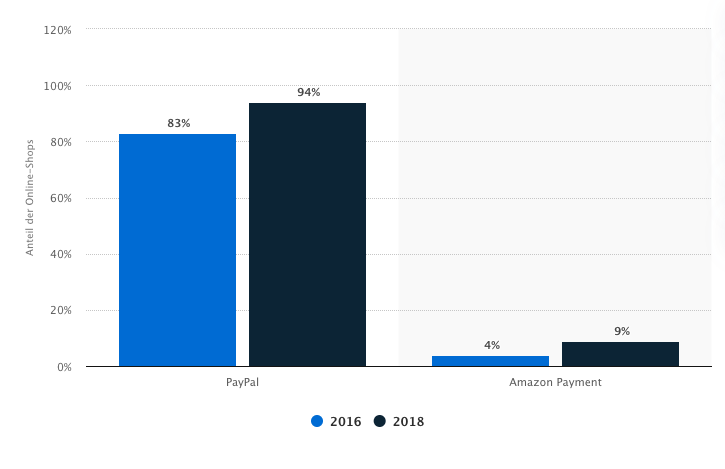

PayPal has established itself in recent years as the largest provider of electronic payments and is quite popular among customers. For shoppers this payment method means security. As for retailers there is certainty that the goods will be paid for. Furthermore, the customer can easily create a PayPal account and link different bank accounts to it. This way he can use his PayPal account to various online stores and does not have to disclose personal data to the shop operator. Hence this principle gives the customer substantial advantage.

PayPal takes about 1.9% of the sum + €0.35 as a service fee for transactions within the European Economic Area. (Source: Trusted Shops)

Invoice

For the customer, buying on account is the safest form of online shopping. The customer orders conveniently, inspects the goods at home and only pays for those items that are actually kept. For many retailers, however, this payment method is the riskiest of all payment methods and therefore reluctantly accepted. Some companies like Zalando, for example, work with a third-party provider to check the creditworthiness of their customers. So if a customer is classified as paying late more often or the total order quantity is too high, he or she will simply no longer be offered the purchase on account as a possible payment method in the checkout.

The SEPA Direct Debit (SDD)

Similar to payment by invoice, the SEPA direct debit is probably one of the most popular payment methods in the e-commerce environment. In principle, “the payee” instructs his bank to debit the invoice amount from the payer’s account. Direct Debits are usually used for recurring payments hence a very convenient payment method for the customer. As for the retailer, there is a medium risk of non-payment.

When paying by direct debit, approx. €0.28 per transaction request is charged to the online retailer(s) as a service fee. (Source: Trusted Shops)

Payment with credit card

This type of payment is one of the oldest payment methods on the Internet. Products in the B2B sector are often paid with credit card, as payment can be made very quickly. But for small online shops this payment method is not that popular since there are fees per booking in addition to the monthly fee. The risk for the online retailer, on the other hand, is relatively low.

Anyone who offers payment with a credit card in their online shop must expect a service fee of approx. 2.95% + €0.25 (using PayMill as an example) per transaction request. (Source:

This type of payment is one of the oldest payment methods on the Internet. Products in the B2B sector are often paid with credit card, as payment can be made very quickly. But for small online shops this payment method is not that popular since there are fees per booking in addition to the monthly fee. The risk for the online retailer, on the other hand, is relatively low.

Anyone who offers payment with a credit card in their online shop must expect a service fee of approx. 2.95% + €0.25 (using PayMill as an example) per transaction request. (Source: Trusted Shops)

Payment in advance

Payment in advance is basically the most retailer-friendly payment method, as it causes no direct costs and is almost risk-free. Every retailer is interested in receiving the invoice amount on his account before the goods are shipped. But exactly this approach does not work well for the buyer, because the product cannot be inspected and has to be paid in advance.

Immediate bank transfer

The immediate bank transfer is another form of advance payment. A well known provider is Sofort GmbH. The invoice amount is transferred quickly through the convenient online banking and the recipient receives his confirmation. For the customer this form offers security of all his data and the retailer is pleased that the transaction is fast processed.

As a service fee, online retailer have to expect approximately1.45% + €0.15 per transaction request. (Source: Trusted Shops)

Financing or installment payment

Installment payments are in line with modern purchasing behavior: buy now, pay later. An ibi research study has shown that 70 % of all retailers were able to increase their sales by offering this type of payment. For shop retailers who offer furniture, electronic products or high-quality fashion, among other things, this payment method can be very effective.

Payment with Amazon Pay

Whoever likes to order from Amazon is most likely also a customer. This payment option is one of many that can be implemented in a checkout. Due to the popularity of Amazon, shops can achieve higher purchase completion rates and additionally the customer does not have to switch to another payment method. Unfortunately, Amazon Payments is currently only offered in a few online stores.

Amazon charges 1.9% of the sum + €0.35 as a service fee for transactions within the European Economic Area. (Source: Trusted Shops)

Choosing the “right” payment method

Every shop retailer must carefully consider which payment methods should be integrated into his online shop. Acknowledging the advantages and disadvantages of the above payment methods is only the first step. Additionally, the following criteria should always be mindfully taken into consideration:

- Risk level

- Customer satisfaction

- Fixed and variable costs

- Integration costs

- Target group and product range.

Conclusion: Compare payment methods

Cash and online payment are not far apart, but in e-commerce, the purchase process is usually more complex. Therefore, payment failures should be avoided as much as possible. And this can be achieved with the right online payment option for your checkout. Moreover, having more payment methods integrated, you increase your payment success rates as well as the global revenue.

If you have any further questions about the ” Checkout “, please feel free to contact us. We will be happy to help you make your checkout not only more user-friendly but also innovative.

Try the 3 Step Checkout Demo now!

Sources:

https://business.trustedshops.de/blog/zahlungsarten-im-internet/ https://www.onlineshop-basics.de/zahlungsarten-und-zahlungssysteme-im-onlinehandel-39.html

https://de.statista.com/prognosen/1080977/top-zahlungsmethoden-deutschland-ecommercedb

https://de.statista.com/prognosen/1080977/top-zahlungsmethoden-deutschland-ecommercedb

https://www.zalando.de/faq/Zahlung/Warum-kann-ich-meine-bevorzugte-Zahlungsart-nicht-auswahlen.html

https://praxistipps.chip.de/online-per-lastschrift-bezahlen-das-muessen-sie-beachten_45348#:~:text=Per%20Lastschrift%20zu%20bezahlen%20ist,des%20Zahlungspflichtigen%2C%20den%20Rechnungsbetrag%20abzubuchen. https://www.bundesbank.de/resource/blob/634056/8e22ddcd69de76ff40078b31119704db/mL/zahlungsverhalten-in-deutschland-2017-data.pdf